In a move that’s grabbing attention across the business world, Ola Electric’s promoter has pledged over 10 crore shares of the electric vehicle company to secure debt for Krutrim, the AI startup founded by Ola’s co-founder Bhavish Aggarwal. With AI reshaping industries and investments pouring into tech ventures, this development signals Ola’s deepening bets on artificial intelligence—despite challenges at Krutrim.

Here’s what you need to know about the deal, the risks, and what it could mean for the future of AI in India.

What Exactly Happened?

Ola Electric Mobility Limited disclosed that 10.71 crore shares—which is 2.43% of its total equity—have been pledged to raise funds for Krutrim Data Centre Private Limited, Aggarwal’s AI-focused venture.

This stake represents 8.09% of the promoter’s total holding in Ola Electric, highlighting how intertwined the two ventures are. The pledge is made in favor of Axis Trustee Services, acting on behalf of several lenders including Avendus Structured Credit Fund II, Avendus Finance, InCred Credit Opportunities Fund I and II, and India Credit Opportunities Fund II.

Importantly, this new pledge replaces an earlier non-disposal undertaking (NDU), which restricted the sale of these shares. Once the pledge is completed, the NDU will be removed.

Why Now? SEBI Rules and Lock-in Period Expiry

This step became possible after the expiry of a lock-in period on certain promoter shares, under SEBI’s Issue of Capital and Disclosure Requirements (ICDR) guidelines. Ola Electric warned that during the transition, both the new pledge and the unreleased NDU might appear in stock exchange records temporarily until systems are fully updated.

This technicality shows how regulatory frameworks and timing play a key role in enabling companies to unlock funding opportunities at critical moments.

Krutrim’s Financial Struggles – A Startup Under Pressure

Krutrim, valued at over $1 billion, had raised $50 million in January 2024. Since then, it’s been aiming to raise up to $300 million more—but those talks have not been confirmed, and the startup has publicly denied them.

Meanwhile, Krutrim is cutting costs. Over 200 jobs have been slashed this year, including 50 from its linguistics team just last week. The company is now focusing more tightly on its cloud platform and model development, rather than wide experimentation.

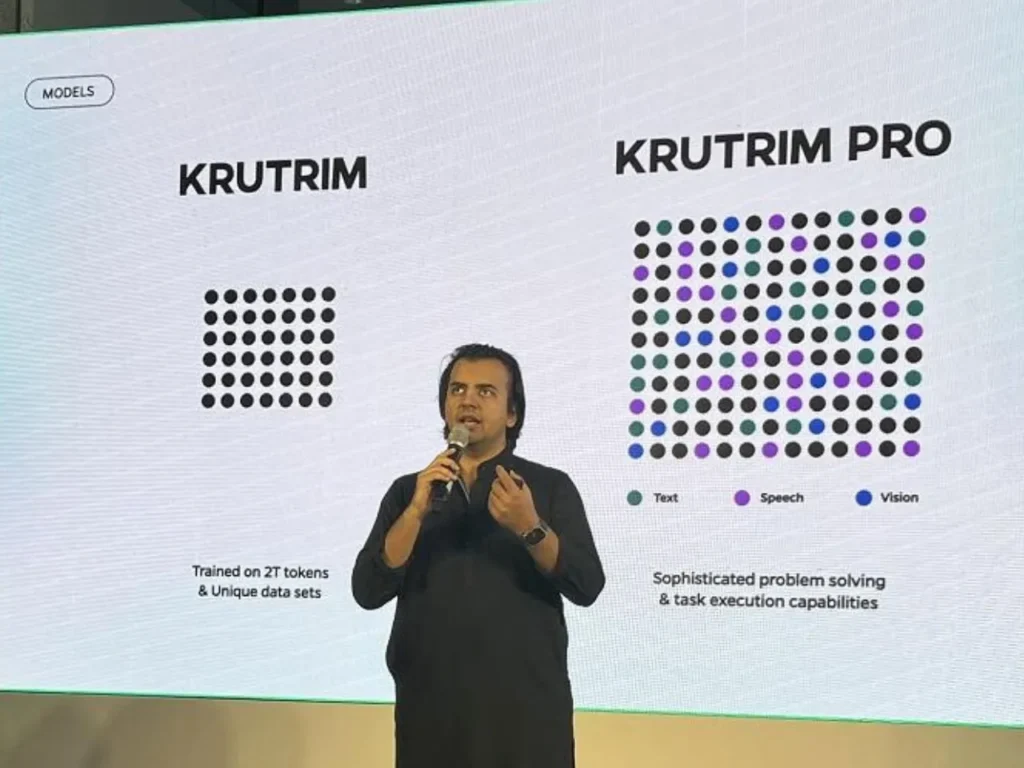

Its flagship offerings—Krutrim Cloud and related AI tools—have yet to gain substantial market traction, forcing leadership to rethink strategy as it works toward developing Krutrim 3, its most ambitious AI model to date, with billions of parameters.

Why Ola’s Support Matters

Even amid operational setbacks, Ola’s backing of Krutrim signals a long-term vision rather than a short-term investment.

Bhavish Aggarwal’s strategy appears to be one of sustained innovation, leveraging Ola’s brand, financial muscle, and investor trust to back a bold AI venture at a time when competition is intense and regulation uncertain.

By pledging shares, the company is effectively betting that Krutrim’s success will eventually fuel not just AI advancements but also create synergies across tech-driven services.

Risks Ahead

However, the risks are real:

- Financial strain: Pledging shares exposes Ola Electric to market volatility. If Krutrim doesn’t gain momentum, investor confidence in both entities could erode.

- Operational pressure: Krutrim’s job cuts and narrowed focus show it’s still finding its footing. Its large language models must now prove their worth to customers and developers.

- Regulatory uncertainty: SEBI’s rules around share pledging and disclosure add complexity and might raise concerns among shareholders about governance practices.

What’s Next?

Krutrim is aiming to scale up its AI infrastructure and compete with global players—but whether it will achieve its lofty goals remains to be seen.

For Ola Electric, the pledge is a bold gamble that reinforces its founder’s belief in AI as a transformative force. The coming months will reveal whether this bet pays off or becomes another high-risk tech experiment.

Investors, analysts, and AI enthusiasts are watching closely as this partnership between electric mobility and artificial intelligence charts a new course in India’s technology landscape.