India’s economic landscape is significantly influenced by its family-owned enterprises, and a new report underscores their immense financial power. The ‘2024 Barclays Private Clients Hurun India Most Valuable Family Businesses’ report reveals that the top family businesses in India collectively hold a staggering valuation of Rs 6,009,100 crore (approximately $460 billion). This impressive figure is comparable to the GDP of Singapore, highlighting the economic clout of these family-led conglomerates.

Ambani Family: The Unchallenged Leader

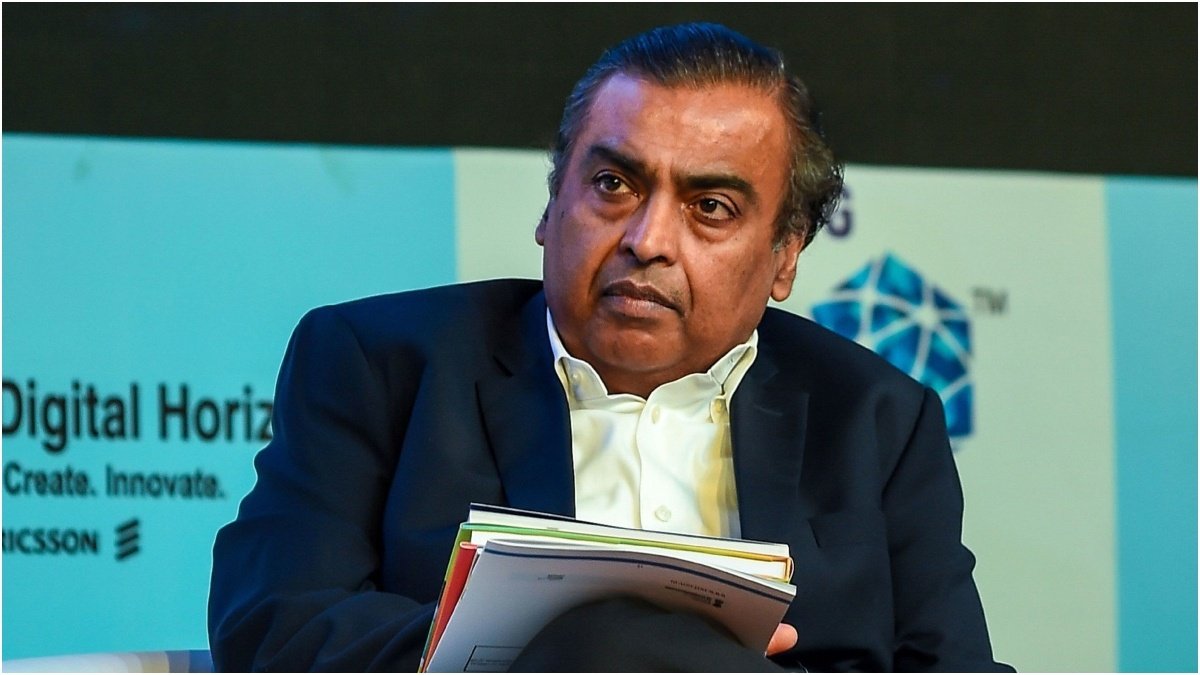

At the pinnacle of this list is the Ambani family, whose flagship enterprise, Reliance Industries, stands out with a colossal valuation of Rs 2,575,100 crore. Founded by Dhirubhai Ambani and now led by Mukesh Ambani, Reliance Industries has diversified its operations across a range of sectors, including energy, petrochemicals, refining, telecommunications, and retail.

Reliance’s dominance in the energy sector, particularly through its extensive refining and petrochemical operations, has been instrumental in driving its valuation. The company has also made significant strides in telecommunications with its Jio network, which has revolutionized the industry with its low-cost data plans and extensive 4G network. The retail arm of Reliance, with its expansive chain of supermarkets and specialty stores, further contributes to its formidable valuation.

Mukesh Ambani’s leadership has ensured that Reliance continues to expand and innovate, cementing the Ambani family’s position as the wealthiest and most influential in India. The family’s wealth is not only a reflection of Reliance’s success but also a testament to the transformative impact of their business ventures on the Indian economy.

Bajaj Family: Automotive and Beyond

The Bajaj family, known for their extensive involvement in the automotive industry, secures the second spot with a valuation of Rs 712,700 crore. The Bajaj Group, founded by Jamnalal Bajaj, is a major player in the manufacturing of motorcycles, scooters, and auto components through its flagship company, Bajaj Auto.

Bajaj Auto, under the leadership of Rajiv Bajaj, has been a significant contributor to the family’s wealth. The company is renowned for its innovation in the automotive sector, with a strong presence both in the domestic market and internationally. Bajaj Auto’s success is attributed to its focus on quality, technological advancements, and strategic expansion into global markets.

In addition to its automotive ventures, the Bajaj Group has diversified into financial services, with Bajaj Finance being a notable player in the consumer finance sector. The family’s investments in various sectors reflect their strategic vision and ability to adapt to changing market dynamics.

Birla Family: Metals and Mining Powerhouse

The Kumar Mangalam Birla-led Aditya Birla Group ranks third with a valuation of Rs 538,500 crore. The group’s success is largely attributed to its dominance in the metals and mining sector, along with its extensive presence in other industries such as cement, telecommunications, and financial services.

The Aditya Birla Group’s metals and mining operations, including its aluminum and copper production, have been crucial in establishing its economic footprint. The group’s foray into telecommunications with its Idea Cellular, which later merged with Vodafone India to form Vodafone Idea, has also contributed significantly to its valuation.

Kumar Mangalam Birla’s strategic vision and leadership have propelled the group’s growth and diversification. The Birla family’s influence extends beyond business, with significant contributions to social and educational causes through the Aditya Birla Foundation.

Other Prominent Family Businesses

Several other family-owned enterprises also make notable appearances on the list, reflecting the diverse economic contributions of India’s family businesses:

- Jindal Family (JSW Steel): With a strong presence in the steel industry, the Jindal family’s JSW Steel is a major player in India’s manufacturing sector. The company’s focus on innovation and expansion has bolstered its valuation and influence.

- Nadar Family (HCL Technologies): The Nadar family’s HCL Technologies has emerged as a leading player in the IT services sector. Founded by Shiv Nadar, the company’s growth and global expansion have significantly contributed to its valuation.

- Mahindra Family (Mahindra & Mahindra): The Mahindra Group, under the leadership of Anand Mahindra, is known for its diversified business interests, including automotive, agriculture, and real estate. The company’s innovative approach and global presence enhance its valuation.

- Dani, Choksi, and Vakil Family (Asian Paints): Asian Paints, a leader in the paint industry, reflects the success of the Dani, Choksi, and Vakil families. The company’s strong market position and brand reputation have played a significant role in its valuation.

- Premji Family (Wipro): Wipro, led by Azim Premji, has made substantial contributions to the IT services industry. The company’s focus on technology and innovation continues to drive its growth and valuation.

- Rajiv Singh Family (DLF): DLF, a major player in real estate development, represents the Rajiv Singh family’s significant influence in the property sector. The company’s projects and developments contribute to its high valuation.

- Murugappa Family (Tube Investments of India): Tube Investments, known for its operations in the manufacturing sector, reflects the Murugappa family’s success in industrial and engineering ventures.

Impact and Influence

The collective wealth of these family-owned businesses highlights their substantial impact on the Indian economy. Their success stories reflect not only their entrepreneurial spirit but also their ability to navigate and thrive in a dynamic business environment.

These enterprises contribute significantly to employment, innovation, and economic development in India. Their influence extends beyond business, with many family-led companies involved in philanthropic activities and social contributions.

As these families continue to grow their enterprises and expand into new sectors, their role in shaping India’s economic landscape will remain pivotal. The substantial valuations of these family businesses underscore their importance in the country’s economic fabric and their capacity to drive future growth.

In conclusion, the remarkable valuations of India’s most valuable family businesses highlight their economic prowess and influential role in the nation’s development. With their diverse interests and strategic vision, these families will continue to play a crucial role in shaping the future of India’s economy.