Omnichannel trade startup Fynd which was obtained via way of means of Reliance in August 2019 and spent round 8 months under Reliance in FY20, positioned a decent manage on its charges throughout that monetary year. The agency scaled back appreciably which brought about a drop in working sales and additionally a discount of losses.

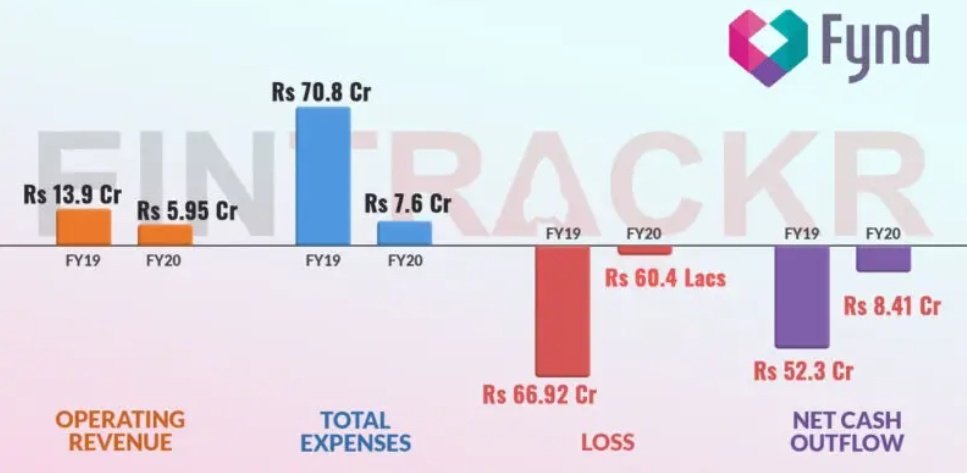

Fynd’s sales decreased by 57.2% to Rs 5.ninety five crore from Rs 13.nine crore in FY19, in line with the agency’s financials filed with the registrar. The drop of 70.1% in its transport expenses additionally depicts a good sized discount withinside the scale of its operations and orders processed throughout FY20. These charges decreased from Rs 6.35 crore in FY19 to Rs 1.nine crore in FY20.

With the discount in scale, the entire expenditure dropped via way of means of 89.2 % from Rs 70.eight crore in FY19 to Rs 7.sixty six crore.

The austerity measures endured to mirror in the course of the rate sheet. Expenditure on marketing and marketing and advertising had been slashed via way of means of 96.6% to most effective Rs 1.04 crore throughout FY20 from Rs 30.sixty two crore in FY19. Employee advantage expenditure additionally decreased via way of means of almost 90% from Rs 17 crore in FY19 to Rs 1.seventy two crore in FY20.

This comes because the startup has been on stealth mode ever for the reason that the purchase as it’s miles predicted to be running on a tech stack which could provide correct visibility of a logo store’s stock in real-time. This is in keeping with Reliance’s emphasis on bridging the space among the bodily and virtual channels thru Jio Platforms. The Mukesh Ambani-led institution is probably to release style vertical on JioMart via way of means of the subsequent month and Fynd is predicted to play a critical position in it.

Fynd’s restructuring approach appears to be running as its losses recovered via way of means of 99.1% to Rs 60.four lakhs throughout FY20 from Rs sixty six.ninety two crore in FY19 and internet coins outflow from operations decreased by 84% to Rs eight.four crore. While remarkable losses piled up to almost Rs 104 crore, EBITDA margins recovered from -403.3% in FY19 to most effective -0.97% throughout FY20.

The agency has raised Rs 50 crore thru trouble of stocks at the same time as it borrowed any other Rs 18.eight crore throughout the monetary resulted in March 2020.

RIL’s Reliance Industrial Investments and Holdings Limited(RIHL) have become the promoter of Fynd with impact from September 24, 2019, through obtaining an 87.6% stake withinside the e-commerce agency. Fynd’s cofounders Farooq Adam Mukadam, Harsh Shah and Sreeraman Mohan Girija diluted their stakes to four.sixty six per each.