Pi Ventures, the beginning phase investment reserve situated in India and zeroed in on man-made reasoning and profound tech new companies, has reported the dispatch of its second asset with an underlying objective corpus of Rs 565 crore ($75 million roughly).

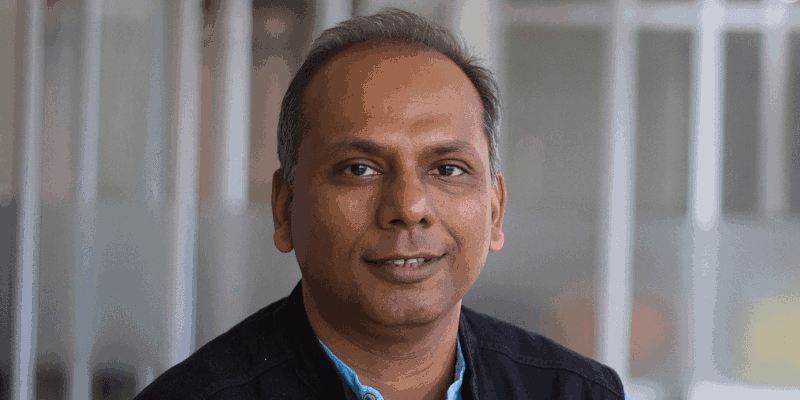

Established in 2016 by Manish Singhal, Pi Ventures is hoping to grow the extent of startup speculations during that time asset to put resources into regions like material sciences, biotech, nanotech, and spacetech to give some examples.

Pi Ventures hopes to close the second asset before the current year’s over, and the last objective could be in the scope of $75-100 million. It had raised Rs 225 crore ($30 million) for its first asset, which was shut in 2018.

As per Manish, given the endeavor asset’s experience throughout the most recent five years of putting resources into AI and profound tech new businesses in India, he felt there were sufficient youthful organizations in the country that could carry significant separation through innovation to take care of an enormous issue.

The second asset of Pi Ventures intends to put resources into around 20-25 new companies, to a great extent at the seed and pre-Series A phases. The check sizes will go from $0.5-1 million.

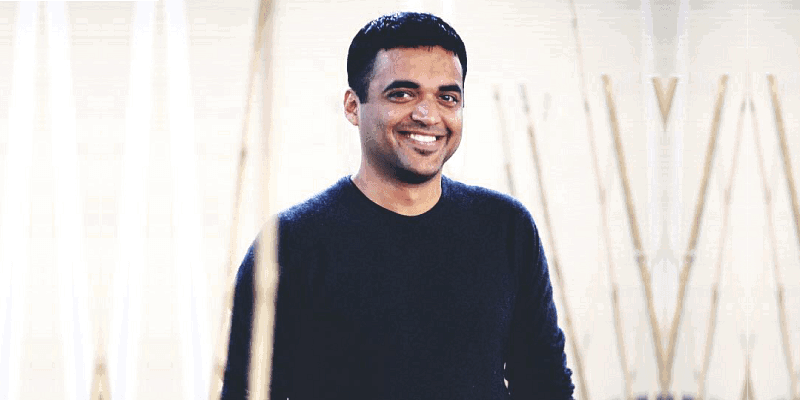

The subsequent asset has pulled in both new restricted accomplices (LPs) just as the current ones. In the principal store, the unmistakable financial backers were CDC UK; IFC World Bank; SIDBI; Hero Enterprise Chairman Sunil Kant Munjal; Electronic Development Fund (oversaw by Canbank Ventures) the corporate financing arm of Hero Electronix; In Color Capital from Canada; Accel Partners; and conspicuous family workplaces and business visionaries like Binny Bansal, Bhupen Shah, Raghuveer Tarra, and Ullas Kamath to give some examples.

In the primary asset, Pi Ventures put resources into 13 new businesses including Niramai, Locus, Wysa, Agnikul, and Pyxis among others.

Manish said, So far, our venture system has functioned admirably and we have a solid arrangement of organizations that have scaled enormously in spite of the current pandemic circumstance.