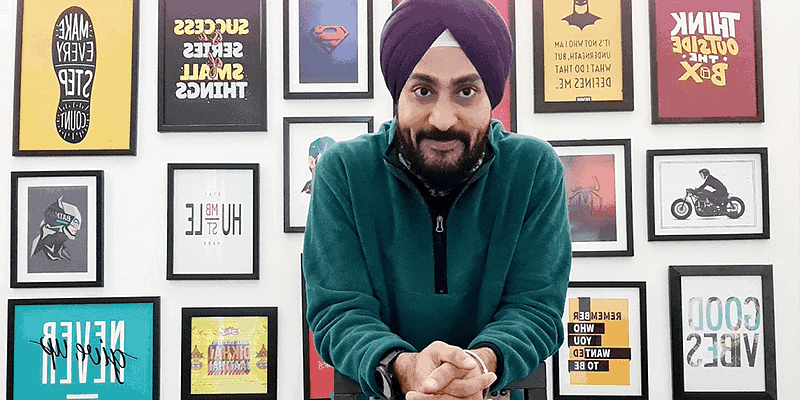

Jasmeet Singh, 37, had not arrived at adulthood when he joined MakeMyTrip, one of India’s initial web triumphs. Yet, around then it was only an obscure startup by an obscure 30-year-old business person, Deep Kalra. The Gurugram startup would proceed to turn into India’s biggest travel booking organization, and Deep, a banner kid for the online travel industry.

MakeMyTrip was formally established at the turn of the thousand years, in April 2000 to be exact; Jasmeet joined the organization the very month, as a 17-year-old understudy, entrusted with doing information sections.

It should be low maintenance gig for him enduring 3-4 months before he set off for college. However, destiny had different plans and Jassi (as he’s prominently known) won’t ever leave. After twenty years, he is a Senior Vice President at the Nasdaq-recorded organization.

By the age of 23, he purchased his first vehicle (a Hyundai Santro); at 25, he had the option to construct his fantasy house (in Gurugram’s DLF Phase 2 area); by 32, he had his fantasy vehicle, a BMW 3 Series M Sport.

“We are one of only a handful few associations where workers can make abundance from RSUs, aside from their yearly income. Investors can encash their RSUs whenever post vesting with no sit tight for buyback, and so on,” says Yuvaraj Srivastava, Group Chief Human Resource Officer at MakeMyTrip.

The Gurugram startup’s stock projects are intended for workers above chief levels and for select representatives till Associate Director level or beneath. Chiefs or more are offered a four-year plan, where stocks are separated into Restricted Stock Units (RSUs) and Performance Stock Units (PSUs). “75% of the stocks are RSUs that are vested similarly over a time of four years and the rest are bucketed under PSUs and are vested for a very long time. Partner Directors and underneath are offered a four-year-program where 10% of the stocks are vested in the principal year, 20% in the subsequent year, 30% in the third year and the 40% in the fourth year,” Yuvaraj adds.

Regarding the portion, stocks are conceded to all representatives at senior administration levels, while mid-administration jobs are allocated shares dependent on execution. Law office LinkiLaw Solicitors clarifies stock vesting as the interaction by which a representative, financial backer, or fellow benefactor is remunerated with offers or investment opportunities however gets the full rights to them throughout a set timeframe or, sometimes, after a particular achievement is hit.

Jassi got his initially set of ESOPs in 2004-05. He concedes he “didn’t see a lot” past the way that “when it becomes shares, will get cash [sic].” From a worker’s viewpoint, ClearTax clarifies ESOPs as an arrangement where a representative gets the advantage of procuring the portions of the organization at the ostensible rate, and sells them (after a characterized residency set by his manager) and makes a benefit.

“At the point when the liquidation happens you understand that out of nowhere you have a great deal of cash. You see a burst in your ledger to the tune of lakhs of rupees,” Jassi shares.

MakeMyTrip recorded on the New York City-based Nasdaq securities exchange in 2010; Jassi was important for the gathering that ventured out to New York for the posting service. Post the posting, the movement booking organization began recruiting from top business colleges.

“You have that thing in your mind ‘how would you rival (these B-school graduates)?’ I advised myself, I should be a stride ahead, spend additional hours and my comprehension of the subject ought to be better, ” Jassi shares sincerely.