Reliance Industries Ltd (RIL) should focus on straightforward practices as financial backers are indicating more noteworthy interest in India’s most important private area organization, said experts. RIL has quit revealing quantitative data in late quarters, which is a reason for worry, as indicated by almost about six experts.

“Throughout the keep going not many quarters, on a quarterly premise, exposures have halted on promoted costs (JioMart), installments to InvITs (framework speculation trusts) from Jio Platforms Ltd (JPL), fragment level retail incomes and profit before interest, charges, deterioration and amortization, capex, and net refining edges (GRM). Financial backers might want more quantitative quarterly revelations across JioMart and JPL to measure the advancement of these organizations,” said JPMorgan in a note on 3 February.

Advanced financial backers, generally in the US and Europe, locate RIL’s drawn out computerized story across JioMart and JPL’s computerized raids appealing even as they concede there is little to anticipate in the following 12-year and a half in these organizations, JPMorgan said. Jio Platforms houses RIL’s computerized business resources, including Reliance Jio Infocomm Ltd, which thusly holds the Jio availability business, portable, broadband and venture, other than others, for example, Jio Apps.

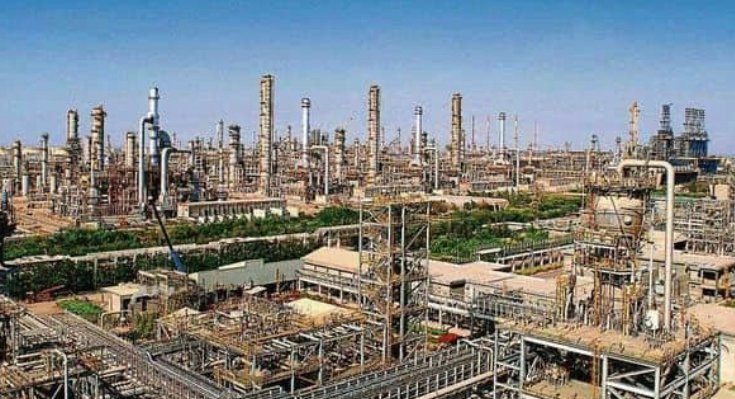

RIL revealed united turnover of ₹659,205 crore and net benefit of ₹39,880 crore for the year finished March 2020. Its organizations range hydrocarbon investigation and creation, oil refining and promoting, petrochemicals, retail, and advanced administrations.

For its second from last quarter profit report a month ago, RIL unexpectedly, didn’t reveal the GRM, a critical measurement for evaluating its refining business. GRM is the edge procured on each barrel of oil prepared. RIL said that with its refining and petrochemicals business being converged into one, oil to synthetics (O2C), it is to be seen as one downstream business.

Experts said they were astounded by the organization’s choice. RIL has not answered to an inquiry from Mint on Tuesday.

“Straightforwardness levels are falling across organizations. RIL has quit announcing a key grid, GRM, out and out. Likewise, it has stopped giving division-wise turnover breakdown to retail and RJio’s key driver FTTH (fiber-to-the-home) needs granularity,” said Edelweiss in a report on 23 January.

BNP Paribas said that the adjustment in announcing makes O2C execution not similar. “We can’t examine the independent business at a granular level as RIL has begun to club its whole O2C activities under one head.”

RIL’s center energy business, particularly refining, has been a drag in FY21 and given travel limitations universally, a recuperation in refining edges is impossible before FY22. Petchem spreads had flooded in December, however from that point forward feature costs and spreads have fallen off.

RIL, which till as of late had been depending on its refining and promoting and petrochemicals organizations for development, is currently pushing its shopper organizations, telecom and retail. Unexpectedly, the purchaser organizations, JPL and Reliance Retail , overwhelmed the income of its center refining and petrochemicals in the December-finished quarter. The computerized administrations and retail organizations revealed Ebitda development of 48.4% and 13.4%, individually.