Melorra, a Bengaluru-primarily based jewellery startup, on Wednesday introduced that it has raised $12.50 million in investment from Symphony Asia (one of Asia’s first private equity firms), Lightbox Ventures and Alteria Capital. Others who participated in the spherical covered current and new family offices of Burman, Jeejeebhoy and others.

The startup stated the budget can be used for technological innovations, product innovations, and advertising to develop the brand recognition and position Melorra as the selection of a new generation.

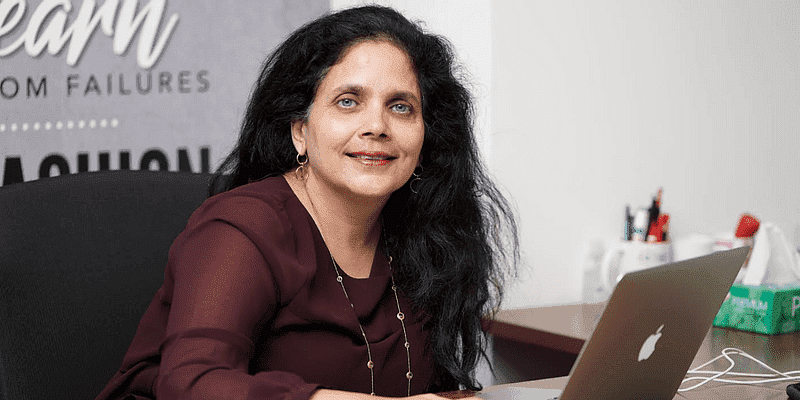

“Melorra is operating at positive unit economics and rapidly regaining its pre-COVID-19 level revenues. This can be attributed to the fact that we are a leader in the daily wear lightweight, trendy jewellery segment. The added benefit during the pandemic is that we are available online which helps us address the customer concerns around trust and safety,” said Saroja Yeramilli, Founder and CEO, Melorra.

Melorra has been into the light-weight gold jewelry segment ever since it began out operations in 2016. The employer claims that it’s been recording elevated boom in order value and numbers ever since the lockdown was lifted. The brand has witnessed a 4X boom in both natural and direct traffic in comparison to last Diwali and the ASP (average selling price) has grown by forty percentage in comparison to pre-Covid levels, it stated.

With a hundred and sixty employees currently, Melorra additionally added that it has delivered to over 1700 cities in the country and made its mark everywhere – from towns with a population of less than 10,000 to those above 1 million.

Siddharth Talwar, Co-founding father of Lightbox Ventures, stated,

‘In March when the pandemic hit, like so many other businesses around the world, Melorra saw sales volumes drop drastically, the future of the jewellery market questioned, and online search traffic heavily decreased. But over the past four months, they have turned the business on its head, in what’s been nothing short of a masterclass. Not only is their revenue on track to surpass pre-COVID-19 levels, but they’ve done it while cutting their marketing spend by over 50 percent, and achieving positive unit economics.”